What Makes Individual Health Insurance Right for NRIs & Expats?

What Is Individual Health Insurance? A Complete Guide for NRIs & Expats

Individual health insurance suits a large number of people who do not have access to Government or employer-sponsored health coverage, or if the coverage is limited in scope. Here’s a guide to the same in this article.

Understanding Individual Health Insurance in a Global Context

In a global context, personal health insurance plays a key role, offering adequate coverage for sudden medical emergencies, treatments, hospitalisation, and more. Unlike region-specific policies, global plans ensure broader access across countries.

Why Should NRIs and Expats Prioritise Personal Medical Insurance?

NRIs and expats should certainly prioritise personal medical insurance, as they may have insufficient or limited employer/domestic coverage. Such plans may not meet the costs of healthcare emergencies or advanced treatments overseas.

Rising Medical Costs and Limited Employer Coverage Abroad

Medical costs are rising significantly across many regions, particularly in the United States, the GCC, and developed economies, making it difficult to manage without individual insurance plans. Additionally, employer coverage abroad may be basic and non-portable, which compounds the risk.

What Is Individual Health Insurance?

Here is a closer look at individual health insurance plans.

Definition and Key Features of Personal Health Insurance

Health insurance plans for individuals are designed for people who wish to obtain independent coverage. Key features include customisable benefits, wide hospital networks, preventive care, urgent and emergency services, mental health support, maternity and newborn care, and flexibility across geographies.

How Does It Differ from Group/Employer-Provided Plans?

Group or employer-sponsored plans differ from medical insurance for individuals in that they are tied to an organisation and typically offer limited, non-customisable coverage. These plans often cease upon termination of employment and may not provide portability across countries.

Who Should Consider an Individual Health Plan?

Expats and NRIs living abroad should consider these plans, as should remote workers, freelancers, international students, digital nomads, and entrepreneurs who are not covered under any group policy.

Benefits of Individual Health Insurance for NRIs & Expats

There are several advantages of choosing the best individual health insurance plans for NRIs and expats:

Financial Independence in Managing Health Risks

An individual plan allows you to manage your health risks independently, helping you avoid depleting your personal savings or long-term investments during emergencies.

Portability Across Countries and Job Changes

Many independent health insurance plans are portable across countries and hospital networks. This ensures uninterrupted coverage if you switch jobs, move to another country, or travel frequently.

Tailored Coverage Based on Personal Healthcare Needs

You can customise your plan to suit your lifestyle, medical history, and health risks, which is often not possible in group policies.

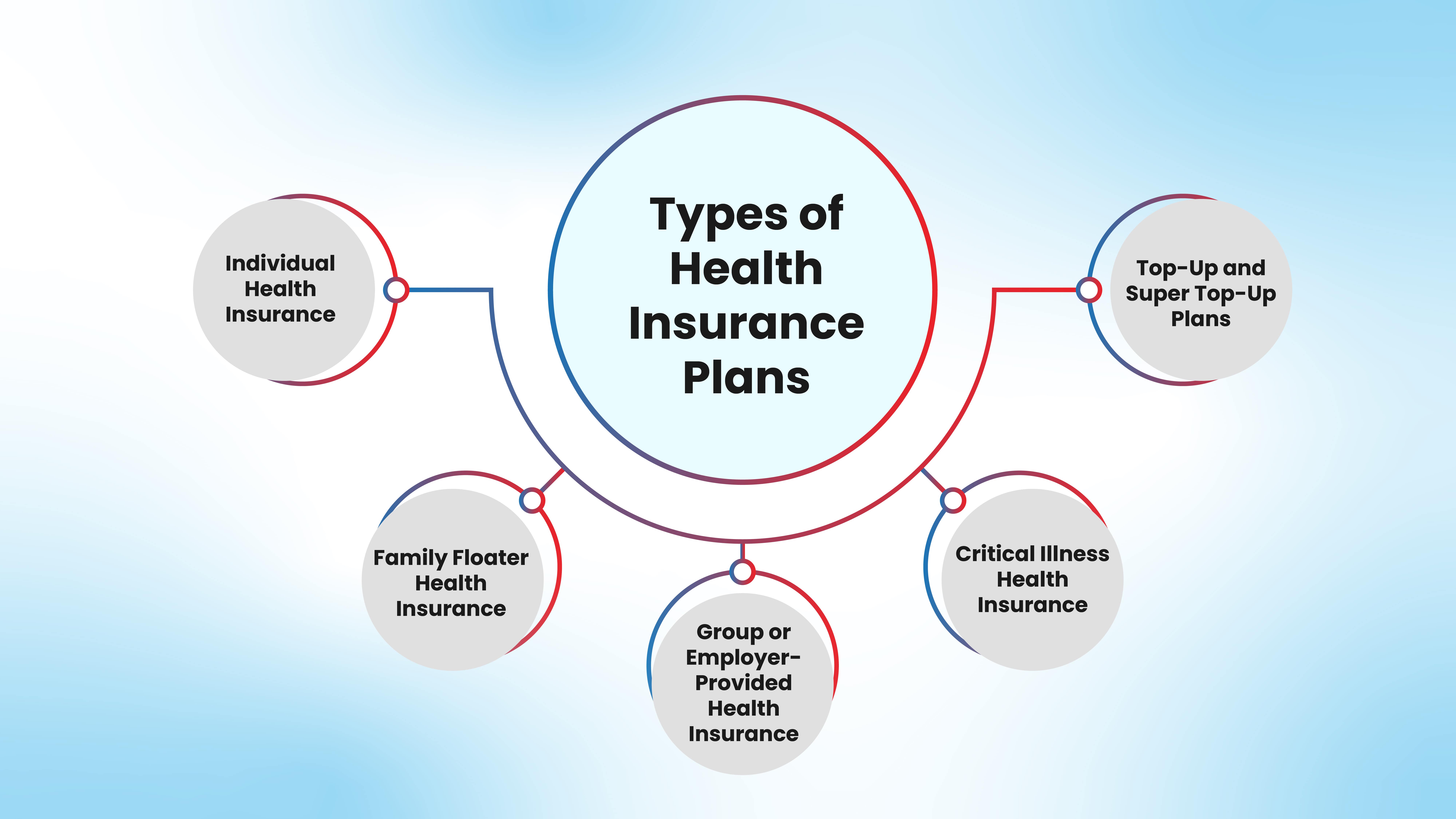

Types of Individual Health Insurance Plans

There are various kinds of medical insurance plans for individuals, such as:

Basic Hospitalisation Cover

Most plans cover hospitalisation, surgery, room rent, diagnostic tests, and doctor consultations.

Critical Illness Cover and Day-Care Procedures

Some plans offer separate critical illness coverage, which pays a lump sum on diagnosis of serious illnesses. Others include day-care procedures and OPD consultations, typically not requiring 24-hour hospitalisation.

International Individual Health Insurance

Several insurers now offer the best health insurance for singles, expats, and global professionals, providing cross-border coverage, multilingual customer support, and wide hospital access globally.

Why International Health Insurance Matters for NRIs?

Employer Coverage Gaps for Expats in GCC & Other Regions

Professionals working in the GCC and other countries often receive basic employer-provided healthcare, which may not cover family members or advanced treatments. This makes individual coverage essential.

Cross-Border Medical Emergencies and Multi-Country Travel

Unexpected health emergencies may occur while travelling. Health insurance plans for individuals with international coverage ensure you receive care without complications, wherever you are.

Benefits of USD-Based Coverage and Medical Inflation Protection

USD-denominated plans help protect against rising healthcare costs and future medical inflation. However, premiums may fluctuate based on currency exchange rates for INR or non-USD earners.

How HDFC Life International Supports NRIs with Global Individual Health Insurance?

HDFC Life International offers specialised support for globally mobile NRIs and expats.

Dollar-Denominated Plans Tailored for Global Citizens

These plans are designed to ensure financial security even during times of inflation or currency depreciation.

Worldwide Hospitalisation and Treatment Access

Enjoy a seamless experience with hospital access across continents, subject to the insurer’s global provider network and pre-authorisation policies.

Ideal for Singles, Professionals, and Mobile Expats

These plans are particularly useful for singles, professionals, and frequent travellers who need stable, cross-border medical coverage.

Easy Onboarding and Strong Claim Support

HDFC Life International ensures a smooth onboarding process that is largely digital. Claims support is prompt, with guidance during emergencies and access to a wide hospital network.

Go for Individual Health Insurance Plans Today

Individual health insurance plans are a critical part of financial planning for NRIs and expats. They ensure access to quality healthcare across borders, even if your job changes or you relocate. HDFC Life International offers a wide range of global individual insurance plans tailored to the needs of internationally mobile professionals and families.

FAQs on Individual Health Insurance

What is the difference between individual and family health insurance?

Individual health insurance covers one person, while family plans cover multiple members under a single policy.

Can I buy international individual health insurance from India?

Yes, NRIs can purchase such plans online through providers like HDFC Life International, depending on policy terms and eligibility.

Is individual health insurance more flexible than employer coverage?

Yes. It offers customisation, portability, and often better long-term value for global citizens.

Does HDFC Life International offer USD-based individual health plans?

Yes. These plans offer cross-border hospitalisation, wide network access, and inflation protection.

What makes international personal insurance ideal for NRIs?

It offers flexible, personal health insurance across multiple countries, coverage continuity during travel, and protection from medical inflation and currency volatility, making it ideal for NRIs and globally mobile individuals.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

31 Aug 2025|6 min read

29 Aug 2025|6 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.