Health Insurance Explained: Plans, Benefits & Global Options

What is Health Insurance and How does it Work?

Health insurance is a necessity these days, particularly with the rising costs of healthcare across the world. To avoid depleting savings and ensure high-quality care, these plans are a must for every individual and household.

What is health insurance: The basics explained

Health insurance is an agreement with an insurance company where an individual or family pays a premium in exchange for financial coverage against medical costs.

Why health insurance matters in a globally mobile world?

Health insurance matters immensely in a globally mobile world, where you may be travelling to various regions on business and leisure.

Health insurance vs medical insurance: Understanding the difference

Although the terms ‘health insurance plans’ and ‘medical insurance’ are often used interchangeably, some providers may use them to indicate slightly different scopes. However, the distinction is not always standard and may vary by region and insurer.

How Health Insurance Works?

There are several ways in which health insurance plans work.

Key terms: Premiums, deductibles, co-pays, and network hospitals

Some of the key terms include the following:

- Premium- The amount paid monthly/periodically to the insurer.

- Deductibles- The amount paid out-of-pocket before the insurer covers costs.

- Co-Pays- A fixed sum paid by policyholders for specific services like prescriptions, doctor’s visits, etc.

- Network Hospitals- Most insurers have a network of healthcare providers where the process is usually smoother.

Claim process: Reimbursement vs cashless treatment

Medical insurance plans come with either reimbursement or cashless treatment mechanisms. The latter is where the insurer directly settles bills at network hospitals, while the former is where you pay the costs first and get them reimbursed later by the insurer.

What influences the cost of a health insurance plan?

The cost of a health insurance policy depends on multiple factors, including age and health condition, riders, coverage amount, etc. You can compare multiple policies to find affordable health insurance.

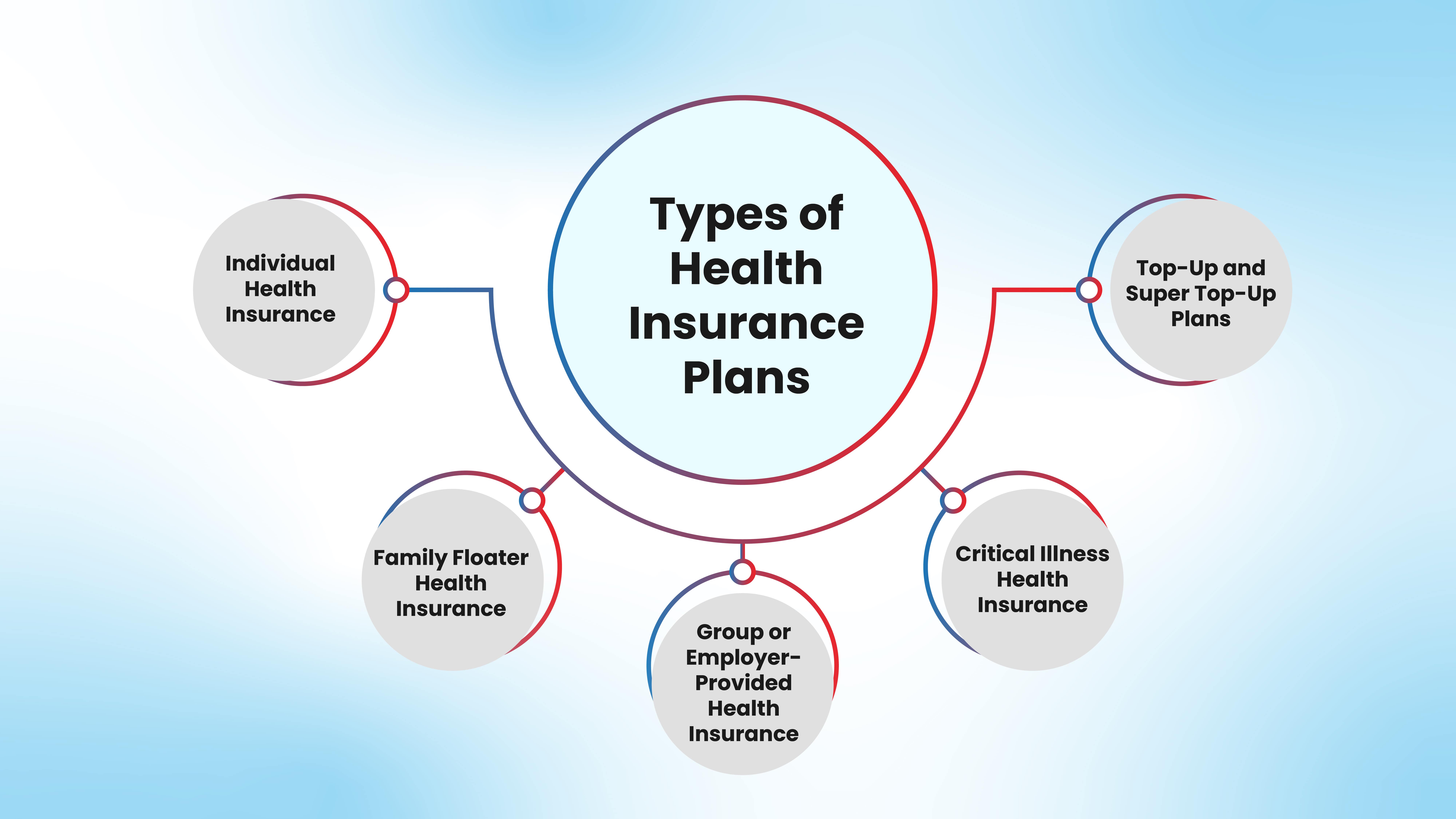

Types of Health Insurance Plans

There are several types of health insurance plans available today. You can request health insurance quotes to compare them effectively.

Individual health insurance

These are plans that cover individual policyholders.

Family health plans

These plans cover the entire family, with the coverage being shared among them.

Group or employer-based insurance

This is coverage provided by companies or specific groups to their employees or members and is typically available only during the period of employment, unless portability options are provided.

Critical illness and add-on covers

You can get add-on coverage with your health insurance plans, including critical illness coverage. This offers a fixed payout upon diagnosis of any life-threatening illness.

International health insurance for global citizens and NRIs

There are several dedicated international health insurance plans for NRIs and global citizens, offering seamless coverage that suits their mobility and requirements.

Why International Health Insurance is Gaining Importance?

The best health insurance plans for NRIs and global citizens are steadily gaining importance, as more people understand the need for medical care coverage that takes care of them even when they’re travelling.

Cross-border coverage for global workforces and NRIs

NRIs and global workforces can gain cross-border medical coverage when they travel to other project sites or for global assignments.

Rising healthcare costs and medical inflation worldwide

The increase in global healthcare costs and rising medical inflation has made it necessary to secure your financial coverage with an international health insurance policy.

Portability and multi-country treatment options

Modern-day international insurance policies come with multi-country treatment options and seamless insurance portability across numerous network hospitals.

Ideal for frequent travellers, expats, and remote professionals

Getting global insurance coverage is thus a must for remote professionals staying in other countries and even expats, frequent travellers, and so on.

Why NRIs in the Middle East and Other Regions Need Global Health Insurance?

NRIs working and living in the Middle East and other regions have a pressing need for global health insurance plans for several reasons.

Limitations of local/employer health insurance in GCC countries

Local health plans or employer coverage are often insufficient to meet the needs of expats in GCC countries, and this necessitates the addition of more coverage to take care of costly treatments and emergencies.

Benefits of USD-denominated global coverage

International health insurance policies often provide USD-denominated global coverage, which helps you counter medical inflation and the rising costs of treatments in multiple countries.

Importance of emergency medical evacuation and international hospital networks

Global hospital networks play a vital role in enabling cashless and swift treatment for NRIs, while emergency medical evacuation and air ambulance facilities are also essential in saving lives and enabling timely access to care.

How HDFC Life International Supports NRIs with Global Health Insurance?

HDFC Life Insurance offers the best global health insurance solutions and support for NRIs.

US Dollar-based plans: Shield against currency fluctuations

US dollar–denominated plans help mitigate such financial risks by securing benefits at reliable international rates.

Comprehensive worldwide coverage for expats and NRIs

HDFC Life International has tailored plans that offer vast global coverage, retaining global mobility while keeping your health coverage intact.

Portability and long-term peace of mind for globally mobile families

With full portability, these plans are ideal for globally mobile families with most medical expenses largely covered, subject to policy terms.

Seamless online onboarding and claims assistance

HDFC Life International plans come with prompt claims assistance and easy online onboarding, which makes it easy for you to secure yourself and your family.

Get Medical Insurance Today

The unpredictability of medical emergencies and soaring healthcare costs make health insurance a global priority. In this pursuit, HDFC Life International empowers global professionals and NRIs with tailor-made health insurance plans.

FAQs on What is Health Insurance

What is international health insurance and how is it different?

International health insurance is portable and globally-applicable coverage for NRIs and expats, which is different from local health plans that apply only in a particular country or region.

Do I need global coverage if I already have local insurance in the Middle East?

You will still need global coverage if you are a frequent traveller and want sufficient coverage for sudden emergencies, not just in the UAE, but worldwide.

Can NRIs buy international health insurance from India?

Yes, they can buy these plans from India, subject to the policy terms, eligibility, and cross-border compliance norms of the insurer.

What are the benefits of USD-based health insurance plans?

They help safeguard against exchange rate and currency fluctuations, while hedging against inflation in medical costs.

Is international health insurance more expensive than regular health plans?

It can be slightly costlier since the coverage is broader and applies to healthcare costs in several countries.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

31 Aug 2025|6 min read

29 Aug 2025|6 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.