Know Why NRIs Need Global Family Health Insurance Plans

What Is Family Health Insurance? Why It’s Ideal for NRIs Abroad?

Family health insurance is a necessity if you wish to cover the entire family in terms of being able to pay for medical costs in case anyone falls ill. Let us learn more about it below.

Understanding family health insurance in today’s globalized world

Health insurance plans for family matter immensely in an increasingly globalized world, where medical emergencies and other healthcare needs may crop up anytime and anywhere, even when the entire family is not physically together.

Why do NRIs and expats need to think beyond individual medical coverage?

In many cases, expats and NRIs need to go beyond individual medical plans and look at proper medical insurance for family, because separate individual coverage may have limitations and higher costs. At the same time, it is important to cover everyone in the family who may be in different regions.

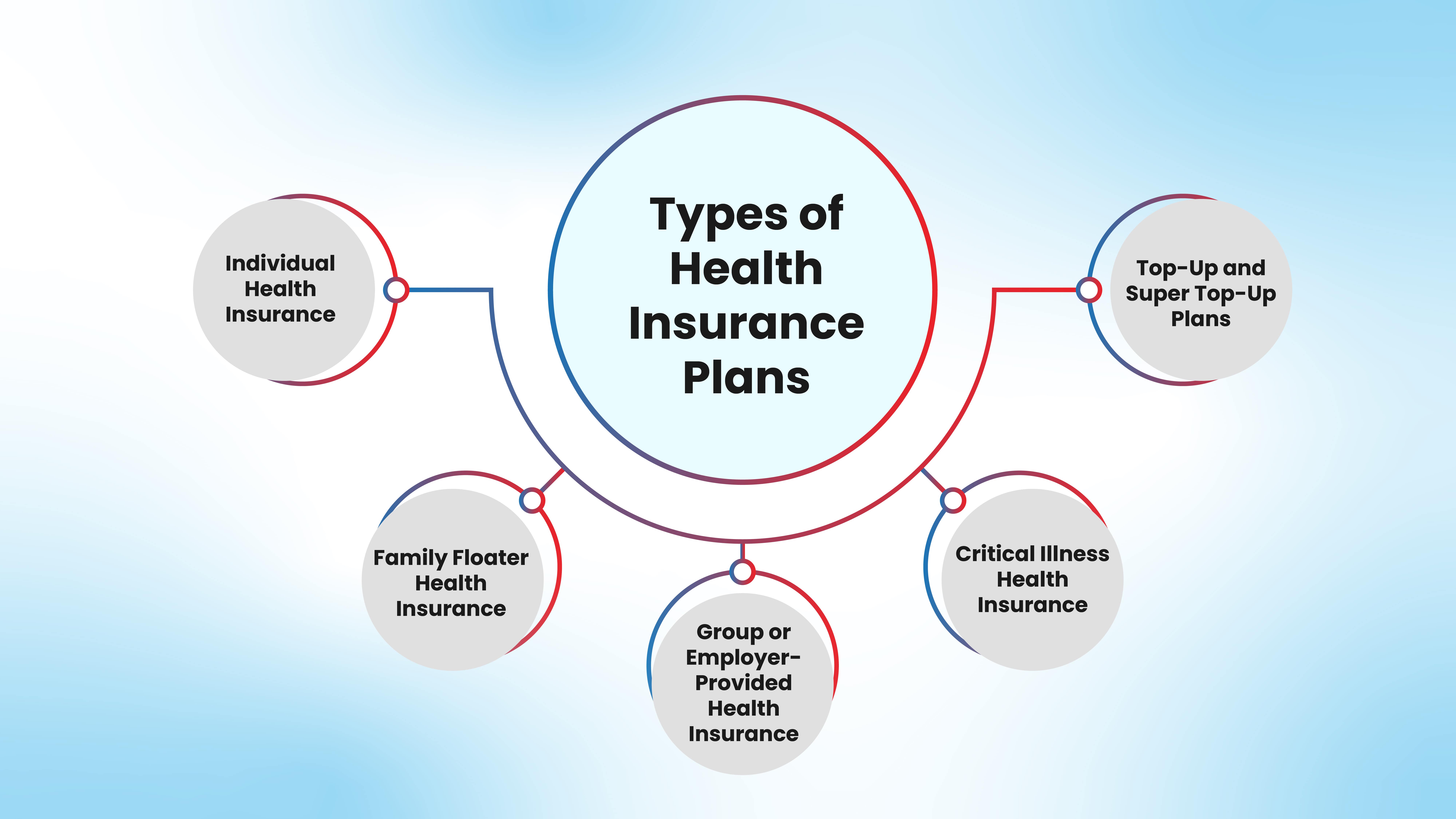

What Is Family Health Insurance?

Here is a closer look at the concept of family health insurance.

Definition and basic concept

In medical insurance plans for family, a single plan offers coverage for multiple family members. They can use the amount to fund medical costs, treatments, and hospitalization.

How does it differ from individual health insurance?

A health insurance policy for family covers multiple members, unlike an individual policy, which offers coverage for just one person.

Typical features: shared sum insured, single premium, multiple members

Some of the usual features of the best health insurance plans for family include a shared sum insured that can be used for the medical costs of one or multiple family members. At the same time, a single premium has to be paid to keep the policy active.

Benefits of Family Health Insurance Plans

There are several benefits of the best health insurance for family:

Cost-effective coverage for the whole family

One of the key advantages is getting affordable family health insurance for everyone in the whole family, which may turn out to be pocket-friendly than individual policies.

Simplified policy management and renewals

You can expect simplified management of your policy, without having to pay multiple premiums or undertake numerous renewals every year for family members.

Inclusion of spouse, children, and sometimes parents

Most domestic family health insurance policies allow you to include your spouse and children, while some even have provisions to add your parents as well. International plans may have separate criteria for parental inclusion.

Cashless hospital access and a wide medical network

Another benefit is that you can get easy, cashless hospital access for treatments and procedures with these plans, along with a vast medical network of hospitals and clinics.

Why do NRIs and Expats Need Family Health Insurance Abroad?

There are several reasons why expats and NRIs require the best mediclaim policy for family members.

Limitations of local employer-provided insurance for family members

Local employer insurance for NRIs may not be sufficient for the whole family in terms of coverage and limitations regarding the inclusion of family members.

Rising private healthcare costs in GCC and other regions

NRIs and expats also need proper coverage in order to combat the increasing private healthcare costs throughout the GCC (Gulf Cooperation Council) and other regions.

Lack of portability in domestic plans when relocating or traveling

Domestic insurance policies do not offer international portability as they are designed for India-only coverage.

What Is International Family Health Insurance?

Here is a look at international family health insurance plans in more detail.

Global coverage across multiple countries

International health insurance plans for family offer global coverage throughout multiple nations/countries, which is a boon for NRIs and expats who travel frequently.

Access to international hospitals, specialists, and emergency services

Comprehensive international plans may offer access to a vast international network of hospitals and specialists, along with emergency services and other healthcare providers.

Ideal for globally mobile NRIs, frequent travelers, and expat families

Globally mobile NRIs and those who travel frequently will need these policies, along with expat families as well.

How HDFC Life International Supports NRI Families with Global Health Coverage

HDFC Life International provides comprehensive family health insurance solutions designed specifically for the unique needs of NRI families.

USD-based plans to combat currency fluctuation and medical inflation

USD-denominated plans are ideal for NRIs dealing in or earning in USD, offering protection from currency fluctuations and medical inflation.

Global hospital network access for your entire family

With HDFC Life International plans, you can get global access to a vast network of hospitals for your whole family without any worries.

Flexibility to cover dependents living across borders

You can flexibly offer healthcare coverage for your dependents who are living across borders and in different regions, which helps in times of sudden emergencies.

Easy digital onboarding and multilingual support

HDFC Life International ensures a seamless digital onboarding process with multilingual support and prompt assistance to considerably smooth the policy buying procedure.

Protect Everyone at Home with Family Health Insurance

Family health insurance offers peace of mind for NRIs abroad.

Family health insurance enables higher peace of mind for NRIs living or working abroad and also with family members in various regions.

International plans offer the portability and security NRIs need

International family insurance plans ensure ample portability and higher security for NRIs, which ensures access to the best treatment and surgeries throughout multiple countries.

HDFC Life International empowers NRI families with globally trusted solutions

With its globally trusted solutions and prompt assistance, HDFC Life International empowers NRI families to take care of their family’s healthcare needs with ease.

FAQs on Family Health Insurance

What is family health insurance, and who can be included?

Family health insurance is a plan tailored for the whole family in terms of covering their healthcare and medical expenses. Spouses and children may be included, while some plans also allow the inclusion of parents.

Is international family health insurance more expensive than domestic plans?

While they may be slightly costlier than domestic plans, they also offer cross-border coverage and vast global healthcare networks, among many other benefits.

Can NRIs purchase family health insurance from India?

Yes, it is possible for NRIs to purchase family health insurance from India and from leading providers like HDFC Life International.

What are the benefits of HDFC Life International’s USD-based plans for families?

Some of the benefits of HDFC Life International’s USD-based plans for families include hedging against medical inflation and currency fluctuations, a vast global network of hospitals and emergency services, and an easy digital onboarding process.

Does family insurance cover dependents living in different countries?

Yes, HDFC Life International’s family insurance plans offer coverage for dependents who are staying in multiple countries.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

16 Jul 2025|7 min read

14 Jul 2025|7 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.