Types of Health Insurance & Which One Is Best for You

Different Types of Health Insurance Plans Explained

There are various types of health insurance that you can consider, depending on your specific requirements. This article provides a closer look at these types.

Why Is Understanding Health Insurance Types Important?

What type of health insurance do I need? This is one question that you should answer at the outset, since health insurance is a lifetime decision, and you should ensure that you get the plan that gives you all the necessary benefits.

Choosing the right plan for your lifestyle, location, and risk factors

It is crucial to choose the right type of health insurance cover depending on your specific location and other risk factors.

Why does this matter for NRIs, expats, and global professionals?

Which type of health insurance is best if you live a global lifestyle, travel frequently, and require emergency cross-border coverage for you and your family? That’s where choosing the right health insurance matters.

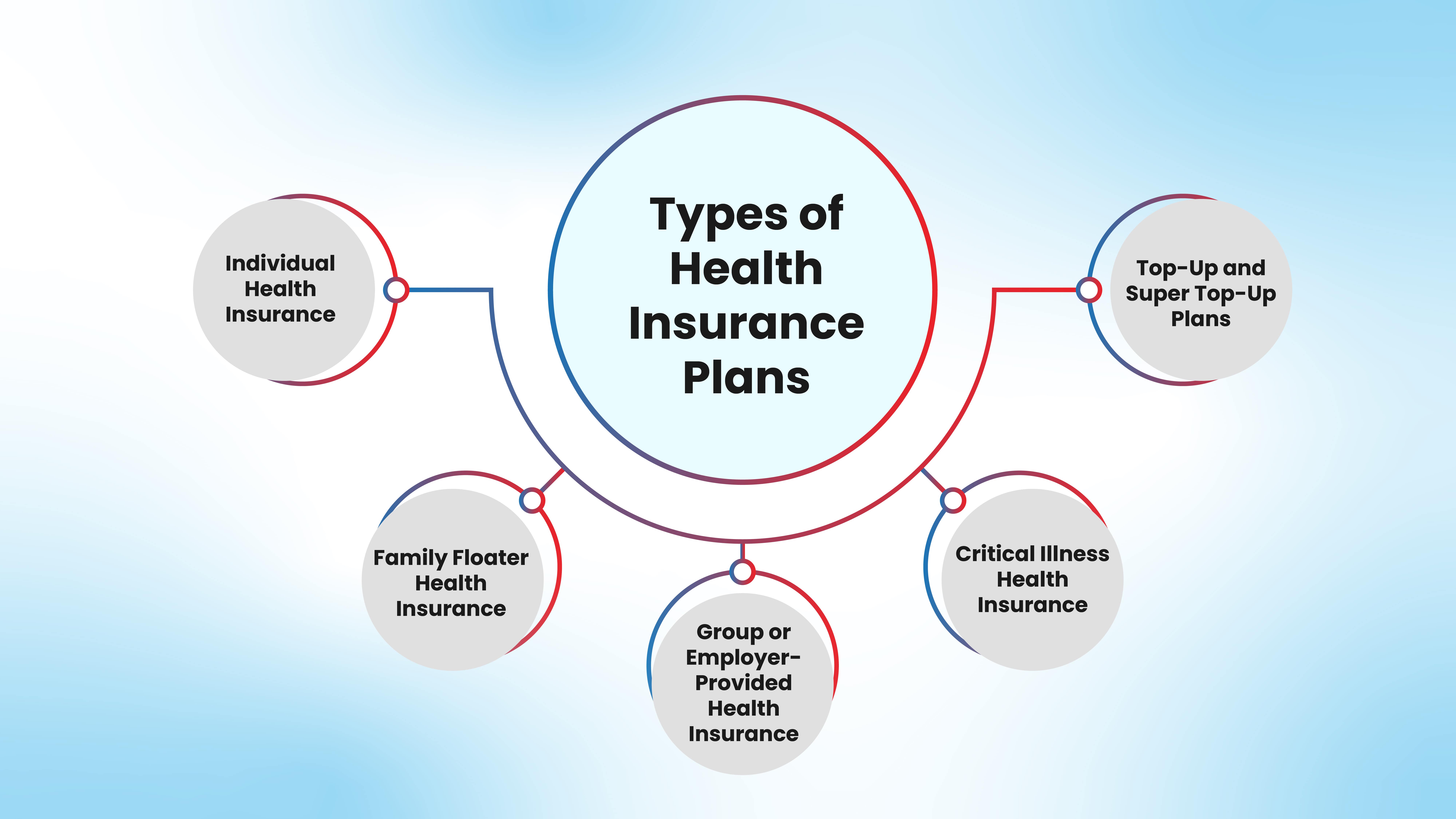

Primary Types of Health Insurance Plans

What is the best type of health insurance plan? Understanding the multiple varieties of these policies would be immensely helpful in this regard.

Individual Health Insurance

This is for an individual person who is offering chosen coverage for a certain premium with specific inclusions/exclusions, coverage benefits, etc.

Family Floater Health Insurance

Family floater health insurance plans offer coverage for the entire family, where the amount can be used by multiple or any individual family members.

Group or Employer-Provided Health Insurance

Many companies or conglomerates offer group or employer health insurance schemes to their employees. These usually come with limited coverage and are typically available only during the course of employment, although post-retirement options may occasionally be offered depending on the employer.

Critical Illness Health Insurance

These health insurance plans offer fixed payouts upon the diagnosis of any life-threatening or critical illness, helping policyholders take care of medical costs.

Top-Up and Super Top-Up Plans

Top-up plans offer added coverage once the deductible is met, but only for a single claim. Super top-up plans extend this benefit to multiple claims in a year. These are more commonly offered under Indian health insurance plans and may not be standard in international insurance structures.

International Health Insurance for NRIs and Expats

This is the best type of health insurance for expats, NRIs, and global professionals who travel frequently and require cross-border coverage.

What is International Health Insurance?

International health insurance offers financial protection for medical costs incurred when you are working, living, or travelling outside your home country.

How does it differ from domestic and travel insurance?

International health insurance coverage is for those living and working abroad for a prolonged period, while travel insurance is tailored for short-term trips and focuses on travel-linked risks.

Why is it ideal for globally mobile individuals and families?

It’s absolutely suitable for globally mobile families and individuals, since they will require adequate healthcare coverage for emergencies and medical costs in multiple locations.

Key features of International Health Insurance

One of the biggest features of international health insurance is cross-border treatment and hospitalisation, along with insurance portability and emergency coverage without restrictions.

When Should You Consider International Health Insurance?

There are various lifestyle scenarios where international health insurance becomes more important for you.

Living or working in more than one country (e.g., GCC nations)

You will need to financially safeguard yourself and your family from healthcare costs and emergencies in case you’re living or working in more than one country.

Travelling frequently for business or personal reasons

Frequent travellers on business or even for personal reasons will need this coverage, since medical emergencies may strike without warning anywhere.

When employer coverage is insufficient or country-limited?

Many employers or companies offer limited coverage that is not enough to meet future medical costs or emergency hospitalisation expenses. At the same time, it is often country-specific, thereby limiting access to healthcare in other countries.

How to Choose the Right Type of Health Insurance Plan?

Here’s how you can select the best types of health insurance for your requirements.

Essential Factors in Your Lifestyle

Keep your travel habits in mind along with your specific coverage needs for your entire family, including dependents. The location you stay at also matters.

Comparing The Fine Print

Compare plan features and benefits across multiple insurers, along with the premiums and inclusions/exclusions for your desired coverage.

What type of health insurance do I need as an NRI or expat?

International health insurance is the best option if you’re an expat or NRI.

How HDFC Life International Offers Health Insurance Tailored for NRIs?

HDFC Life International offers tailored health insurance policies for NRIs and expats. Here are some of their key features.

- US Dollar-based health insurance plans: Protection from currency risks

- Global coverage across countries and hospital networks

- Portability and peace of mind for mobile families

- Simple onboarding, claims support, and digital servicing

Explore Various Types of Health Insurance Today

The type of health insurance you choose will be influenced by your risk exposure and lifestyle. This is especially important for expatriates and globally mobile non-resident Indians (NRIs) who frequently travel across countries or live and work abroad. Consider exploring the variety of global health insurance plans offered by HDFC Life International, designed to keep you secure anytime and anywhere, so you can travel without worries.

FAQs on Types of Health Insurance

Which type of health insurance is best for international travellers and expats?

International health insurance is ideal for global travellers and expats.

How is international health insurance different from travel insurance?

It is different, since it covers medical costs in a broader way, irrespective of the location, and for the long term. Travel insurance covers short-term travel-related liabilities like loss of luggage, flight delays, etc.

Can I switch from group coverage to international insurance?

Yes, you can switch to an international insurance plan once your group coverage ends. However, formal portability of benefits, such as waiting periods or coverage continuity, may not always apply when transitioning from a domestic group plan to a new international policy.

Are USD-based insurance plans better for NRIs in the Middle East?

They are better, since they safeguard against future inflation, currency, and exchange rate fluctuations, etc.

What should I consider when choosing an international insurance provider?

Check factors like the premium, inclusions/exclusions, riders, reputation of the insurer, and coverage amount.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

23 Aug 2025|6 min read

16 Jul 2025|7 min read

14 Jul 2025|7 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.