Travel Insurance vs International Health Insurance Guide

Travel insurance vs international health insurance: A Comparative Guide

The debate on travel insurance vs international health insurance needs to be addressed, particularly with global concerns among frequent travellers, NRIs, and expats.

Why does understanding the difference between travel and international health insurance matter?

Knowing the difference between international health insurance and travel insurance matters immensely, since you should be sure that you’re getting the right kind of plan for your needs.

Common misconceptions among frequent travellers and NRIs

NRIs and frequent travellers have several common misconceptions regarding travel insurance, thinking that it offers ample coverage for medical treatments and emergency hospitalisation across multiple countries.

How does this choice impact your global healthcare access?

This choice will have a direct effect on global healthcare access, since it will influence the extent and type of healthcare coverage that you get.

What Is Travel Insurance?

Travel insurance mainly covers various issues related to any particular trip or time spent abroad. It is ideal for holidays and short-term travel needs.

Short-term coverage for emergencies during travel

Travel insurance offers short-term coverage for sudden emergencies during travel, which span several categories.

Typical inclusions: lost baggage, flight delays, emergency evacuation

Some typical additions include unforeseen flight delays, baggage losses, emergency evacuations, and so on. It may also include limited health insurance for issues related to the specific journey/trip.

Limitations of travel insurance for long-term or routine healthcare

Travel insurance has its own limitations for routine or long-term healthcare. It does not offer coverage for routine medical check-ups, added features, wellness benefits, or extensive medical services like an international health insurance plan. Some travel insurance plans may provide limited coverage for pre-existing conditions, although this typically comes with strict exclusions, underwriting requirements, or additional riders, making it far less comprehensive than international health insurance.

What Is International Health Insurance?

International health insurance is a specialist offering tailored for NRIs and expats who live and work overseas, travel frequently, and have higher global mobility. This will help access extensive healthcare and emergency services at a cross-border level, along with wider benefits in comparison to regular travel insurance.

Comprehensive medical coverage across countries

You can get comprehensive medical coverage across a vast network of hospitals and providers throughout multiple countries and regions.

Designed for long-term stays, expats, NRIs, and globally mobile individuals

This insurance type is more suitable for long-term stays and relocation abroad, while being tailored to globally mobile people, NRIs, expats, and so on.

Covers outpatient care, hospitalisation, chronic conditions, maternity, and more

There is coverage for both inpatient and outpatient care, along with surgeries, treatments, hospitalisation, maternity care, chronic ailments, ambulance charges, and a lot more.

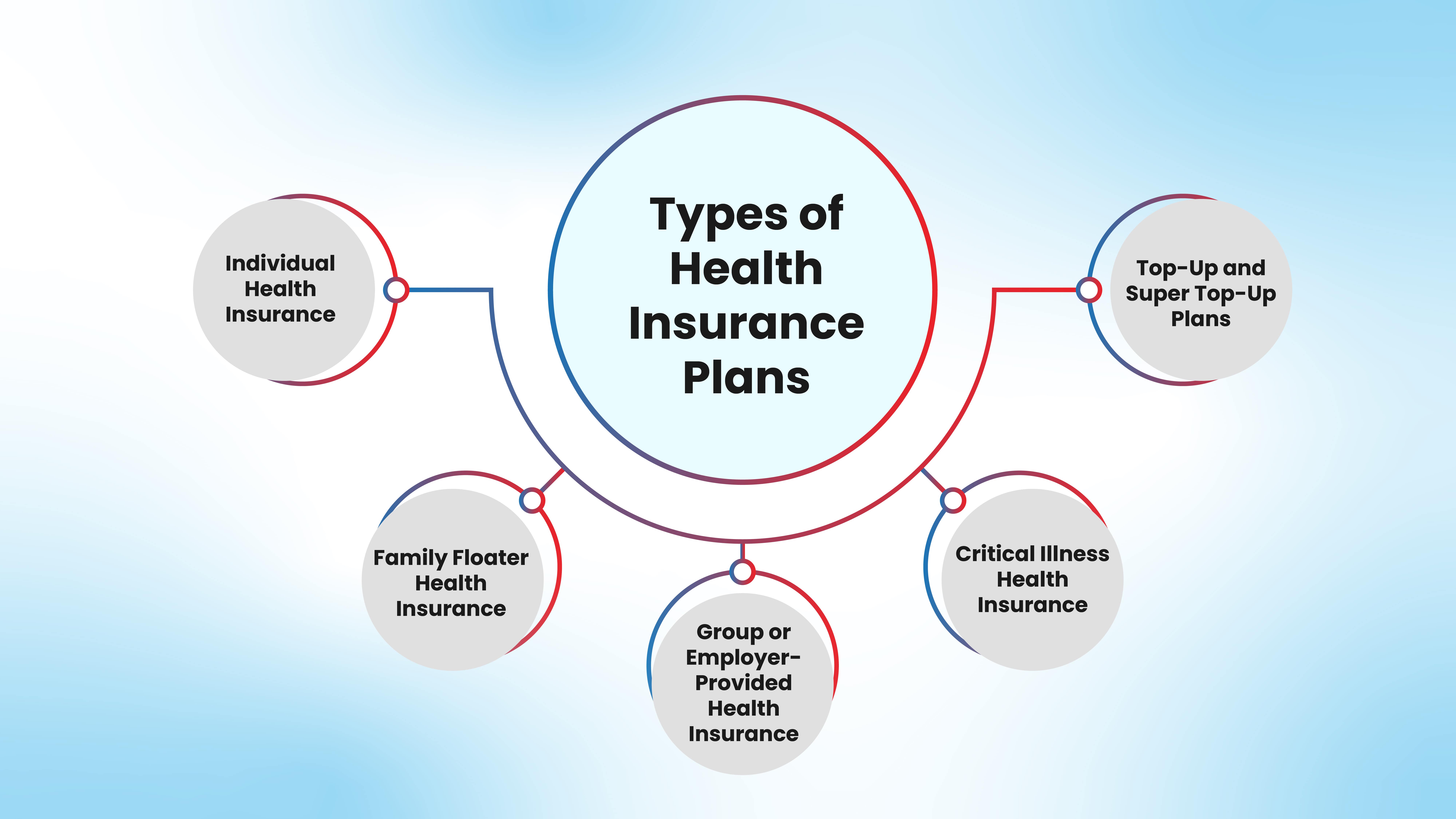

Key Differences: Travel Insurance vs International Health Insurance

Here are the major differences worth noting in the debate on travel insurance vs international health insurance.

Coverage duration: trip-specific vs annual or long-term

Travel insurance offers trip-specific or short-term coverage, while international health insurance offers annual or long-term coverage.

Purpose: emergency support vs full healthcare system

Travel insurance offers funding and support for emergencies, while international health insurance offers access to the entire system of healthcare.

Claims process and medical networks

The medical networks are vast in the case of international health insurance, and you get access to cross-border hospital and clinic options. At the same time, there is a slightly different claims process with cashless treatment or reimbursements. Travel insurance may also offer cashless hospitalisation during emergencies, but typically requires prior approval from the insurer or their global assistance provider, and has smaller medical networks.

Premium costs vs value and benefits received

Premiums are higher for international health insurance, although you get more value in terms of an extensive healthcare system and benefits.

Why NRIs and Expats Need International Health Insurance?

International health insurance is a necessity for expats and NRIs for several reasons.

Limitations of employer-provided or local coverage in GCC/Middle East

Local insurance coverage may be insufficient for NRIs or expats working in regions like the Middle East or GCC. At the same time, employer-provided coverage may also fall short in offering extensive protection for all your needs. This may also have domestic or regional limitations. In some countries, such as the UAE or Saudi Arabia, international insurance must be supplemented with mandatory local coverage to meet regulations.

Need for access to top international hospitals

There is also a need for NRIs and expats to access leading global hospitals and healthcare providers/specialists in case of emergencies abroad.

Medical inflation and lack of portability in traditional plans

International health insurance helps solve the challenges of portability in traditional plans, while also helping cover medical inflation in the future.

How does HDFC Life International offer comprehensive health insurance for NRIs?

HDFC Life International offers extensive health insurance coverage for NRIs and expats.

US Dollar-denominated plans that protect against currency risks

You get US dollar-denominated plans, which safeguard against future currency fluctuations and risks, along with exchange rate changes.

Global healthcare access with emergency & non-emergency treatment

HDFC Life International also offers vast global healthcare access for both non-emergency and emergency treatments through its cutting-edge networks.

Tailored coverage for NRIs in the Middle East and beyond

If you’re an NRI working in the Middle East and even beyond, you will get tailored coverage options. However, be mindful of local statutory health insurance requirements in GCC countries, which may need to be fulfilled in parallel.

Hassle-free onboarding, portability, and international claims support

HDFC Life International also ensures seamless onboarding and adequate portability for smooth customer journeys, along with international claims support for higher peace of mind.

Plan and Get Insurance

Travel insurance cannot replace international health insurance in terms of the latter’s scope and extent of coverage. Global citizens and NRIs require long-term and consistent medical protection, particularly at a cross-border level, making international health insurance necessary. Check out the wide range of plans offered by HDFC Life International to gain long-term mental peace and adequate coverage across borders.

FAQs on Travel Insurance vs International Health Insurance

Is travel insurance enough for expats or NRIs?

Travel insurance is not sufficient for NRIs or expats, since they require long-term and more extensive healthcare protection.

What is the main difference between travel and international health insurance?

The latter is annual or long-term, while being more extensive in terms of healthcare coverage, while the former is on a trip-specific or short-term basis, with specific inclusions that are travel-related.

Can I use travel insurance for routine doctor visits abroad?

Generally, travel insurance does not cover routine doctor visits abroad and primarily offers coverage for emergency medical expenses that are travel-related.

Is HDFC Life International's health insurance available to NRIs?

Yes, HDFC Life International offers international health insurance plans tailored for the needs of NRIs and expats.

How long does international health insurance coverage last?

The duration varies based on the policy type, although it may be long-term or annual with renewals.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

29 Aug 2025|6 min read

27 Aug 2025|6 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.