Travel Insurance vs Health Insurance: Key Differences

Travel Insurance vs Health Insurance: What’s the Difference and Which Do You Need?

The debate on travel insurance vs health insurance has to be understood carefully since both are essential protection mechanisms for people and their families.

Why Does Understanding the Difference Between Health And Travel Insurance Matter?

Knowing the difference between travel insurance vs medical insurance is essential, since you will basically need both for varying purposes, and there should not be any confusion between them. It will only cost you in the long run if something of that sort happens.

How Do Travel Needs And Medical Needs Differ During Short And Long-Term Trips?

One of the key points of difference between health insurance and travel insurance is that the former is for long-term stays abroad, while the latter is for short-term trips. Whenever it is a long-term trip, then the need for dedicated health insurance comes into play since people require access to routine checkups and more comprehensive healthcare services.

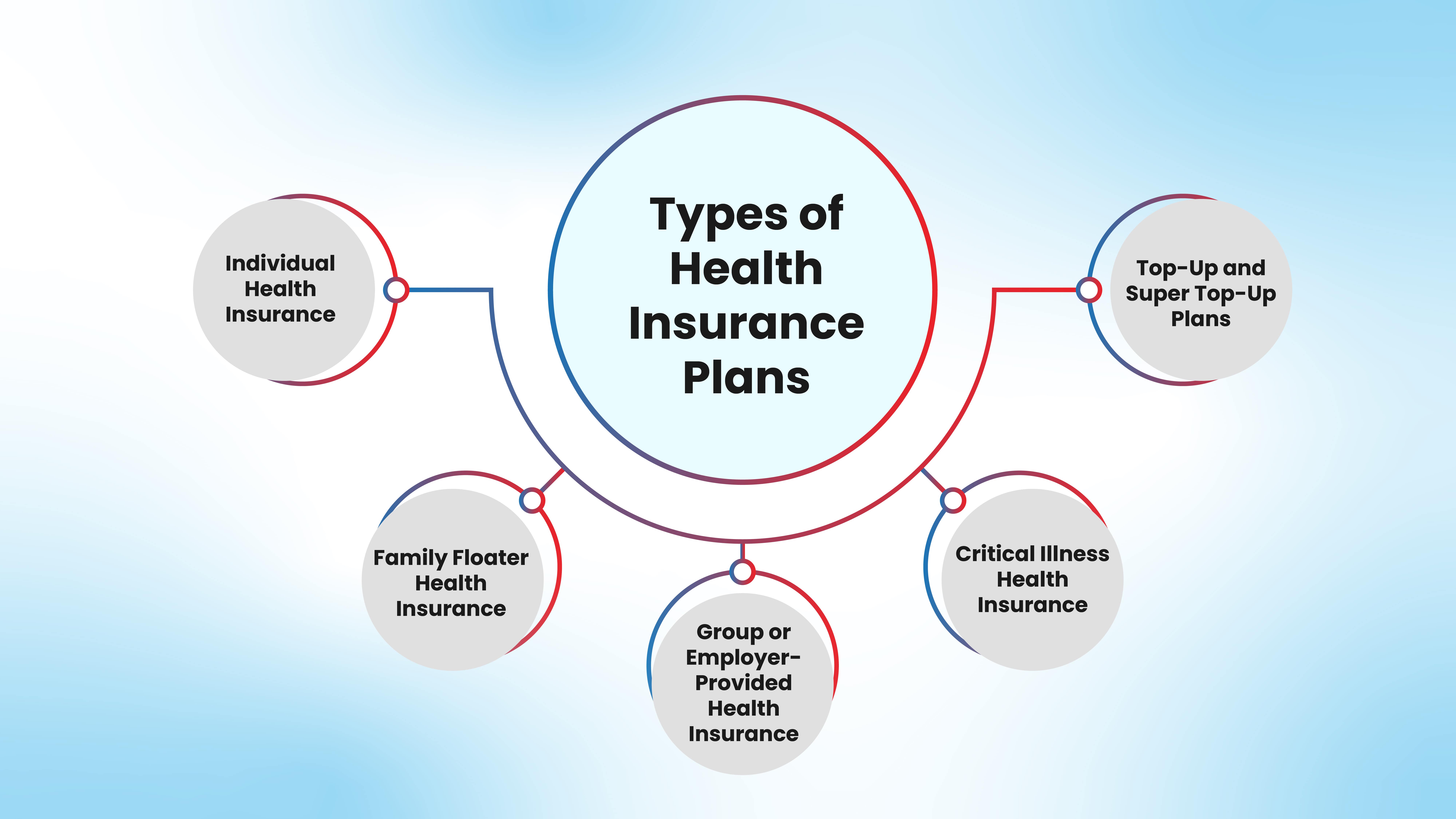

What Is Health Insurance?

Definition And Purpose Of Health Insurance

Health insurance is specific coverage that you gain from the insurance company in return for paying a certain premium amount and for a particular duration. This covers various aspects like hospitalisation, treatments/surgeries, consultations, and more. Patients do not have to pay the funds for medical care from their own pocket, subject to the overall assured amount.

Coverage details: Hospitalisation, outpatient, long-term illnesses

Coverage usually encompasses long-term ailments or critical illnesses along with outpatient and inpatient care (at times), hospitalisation, treatments, and more.

Typical use cases: Residents, families, chronic care, emergencies

Health insurance is useful for those residing in a particular location, along with families and those who require chronic care and treatments. People also need this coverage during emergencies.

What Is Travel Insurance?

Travel insurance is short-term and limited coverage that covers various short-term or trip-related risks. These plans come in handy during sudden emergencies while travelling.

Coverage details: Trip delays, baggage loss, emergency evacuation

This coverage usually includes everything from flight or trip delays to baggage losses, emergency evacuation, and sudden medical emergencies while travelling.

Typical use cases: Short vacations, business trips, tourism

The regular use cases are slightly different from health insurance, with travel insurance being necessary for those visiting other countries/regions for leisure/tourism purposes or going on business trips. It’s also suitable for people taking shorter vacations/trips for varying purposes.

Travel Insurance vs Health Insurance: Key Differences

Here is a guide to the difference between health insurance and travel insurance.

Coverage Scope: Medical Care vs Travel Disruptions

Medical care is the focal point of health insurance, which offers coverage for varying costs ranging from hospitalisation to treatments. On the other hand, delays, disruptions, baggage losses, evacuations, and other travel-related risks are covered by travel insurance primarily.

Duration of Coverage: Long-term vs Trip-specific

Health insurance is for the long term and can be renewed annually, while travel insurance is trip-specific and is for a much shorter duration.

Network and Claims Process: Hospitals vs Travel Service Providers

Travel service providers are the ones who usually book insurance for their customers and take care of claims and other support, including offering a relatively limited network of hospitals/providers for specific healthcare aspects covered in these plans. On the other hand, leading insurance companies offer health insurance policies that have vast networks of hospitals and clinics, along with specialists and emergency support. There is also a dedicated claims process and prompt support.

Is Medical Treatment Abroad Covered Under Travel Insurance?

Some travel insurance plans cover medical treatment abroad in emergency situations during your trip.

When You Might Need Both?

Frequent Travellers And Expatriates

Expats and frequent travellers will need both health insurance for comprehensive coverage and mental peace, as well as travel insurance to take care of travel/journey-related risks.

People Relocating For Work Or Studies

If you’re relocating elsewhere for studies/work, then you will require health insurance for financial support for your long-term medical needs and travel insurance for the journey/travel-related issues.

Why Combining Both May Offer Full Protection?

Combining both these plans may offer what you call full protection, since you safeguard your travels and your long-term healthcare needs together.

Why International Health Insurance Is the Best Long-Term Solution for NRIs?

Domestic health and travel insurance come with several regional restrictions, along with insufficient coverage at times. International health insurance offers cross-border and continuous coverage for higher peace of mind and greater safety during emergencies. They are ideal for expats, globally mobile professionals, and NRIs looking to secure themselves with suitable health coverage.

How does HDFC Life International Support NRIs with Global Health Insurance?

USD-Based International Health Plans For Global Citizens

You get USD-denominated international plans that hedge against medical inflation and currency fluctuations in the future.

Coverage That Goes Beyond Short Trips Or Local Treatment

You can be covered even when you’re out of the country and elsewhere, instead of being restricted to short trips or local treatment, giving you more flexibility.

Comprehensive Plans Designed For NRIs Living In The Middle East Or Relocating

HDFC Life International offers comprehensive health insurance plans tailored for NRIs staying in the Middle East and other countries or even relocating to other nations.

Choose Between The Two

Travel and health insurance are essential, but serve varying and crucial purposes, covering both your long-term healthcare requirements and travel-related risks.

For NRIs and expats, international health insurance offers complete peace of mind

International health insurance gives you complete mental peace if you’re an expat or NRI, knowing that your healthcare needs are fully secured.

Explore HDFC Life International’s global health plans tailored for your lifestyle

HDFC Life International offers a diverse suite of global health plans that are designed to suit your needs and lifestyle for maximum benefits.

FAQs on Travel Insurance vs Health Insurance

Is travel insurance enough if I have health insurance?

You can combine travel insurance with health insurance for more comprehensive coverage.

Does travel insurance cover hospitalisation expenses?

Travel insurance covers specific types of hospitalisation expenses that are trip-related.

Can I buy international health insurance instead of travel insurance?

Yes, it will offer comprehensive and long-term health coverage if that’s what you’re looking for, although it won’t offer coverage for other travel-related risks like baggage losses, flight delays, etc.

What are the benefits of combining travel and health insurance?

The primary advantage is that you can cover both your trips and long-term healthcare needs seamlessly through this system.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

31 Aug 2025|6 min read

27 Aug 2025|6 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.