Tax-Efficient Investment Options for NRIs in the Middle East

Tax-Efficient Investment Strategies for NRIs in the Middle East

Tax-efficient investing for Non-Resident Indians (NRIs) in the Middle East comes with unique challenges and opportunities. This includes exploring tax-free investments for NRIs in UAE and broader strategies across the GCC region. Knowing these strategies is key to maximising returns while minimising tax liabilities. This article discusses different tax-efficient investments for NRIs (Non-Resident Indians) in the Gulf Cooperation Council (GCC) countries and India.

Why Tax Efficiency Matters for NRIs in the Middle East

Tax-efficient investments for NRIs have a direct impact on their investment returns. Apart from that, a few GCC countries do not even levy personal income tax, allowing NRIs to maximise their financial growth.

Understanding Tax Benefits and Exemptions in GCC Countries

GCC countries like UAE, Saudi Arabia and Qatar have a few GCC tax benefits for expatriates:

-

No Personal Income Tax: Most GCC states do not charge personal income taxes, allowing NRIs to retain a higher portion of their earnings.

-

Capital Gains Tax Exemptions: Several GCC countries do not impose capital gains tax on investments, which makes them great tax-efficient investments for NRIs.

-

No Inheritance Tax: While most GCC nations do not levy inheritance tax, estate distribution is generally governed by Sharia law, which can affect how assets are passed on.

How Strategic Investments Can Optimise Financial Growth

Financial growth is greatly supplemented by the strategic investments you made as NRI. Choosing appropriate investment vehicles enables NRIs to have a dual effect of being both tax efficient and having a high return portfolio.

Key Tax Advantages for NRIs in the Middle East

No Personal Income Tax in GCC Countries: What It Means for NRIs

NRIs can invest in GCC without fearing immediate tax burden because GCC does not have a personal income tax. This creates an environment that causes savings rates and investment levels to rise.

Capital Gains and Inheritance Tax Exemptions in Select Middle Eastern Nations

Some countries in the Middle East have exemptions from capital gains and inheritance taxes. This makes real estate and other investments more attractive, as they can appreciate without large tax bills.

Cross-Border Taxation Considerations for NRIs with Indian Financial Ties

When investing, NRIs need to be mindful of cross-border taxation issues. India has signed Double Taxation Avoidance Agreements (DTAAs) with several GCC countries, such as the UAE, Saudi Arabia, Oman, Kuwait, and Qatar, which helps minimise the risk of being taxed twice on the same income in both jurisdictions.

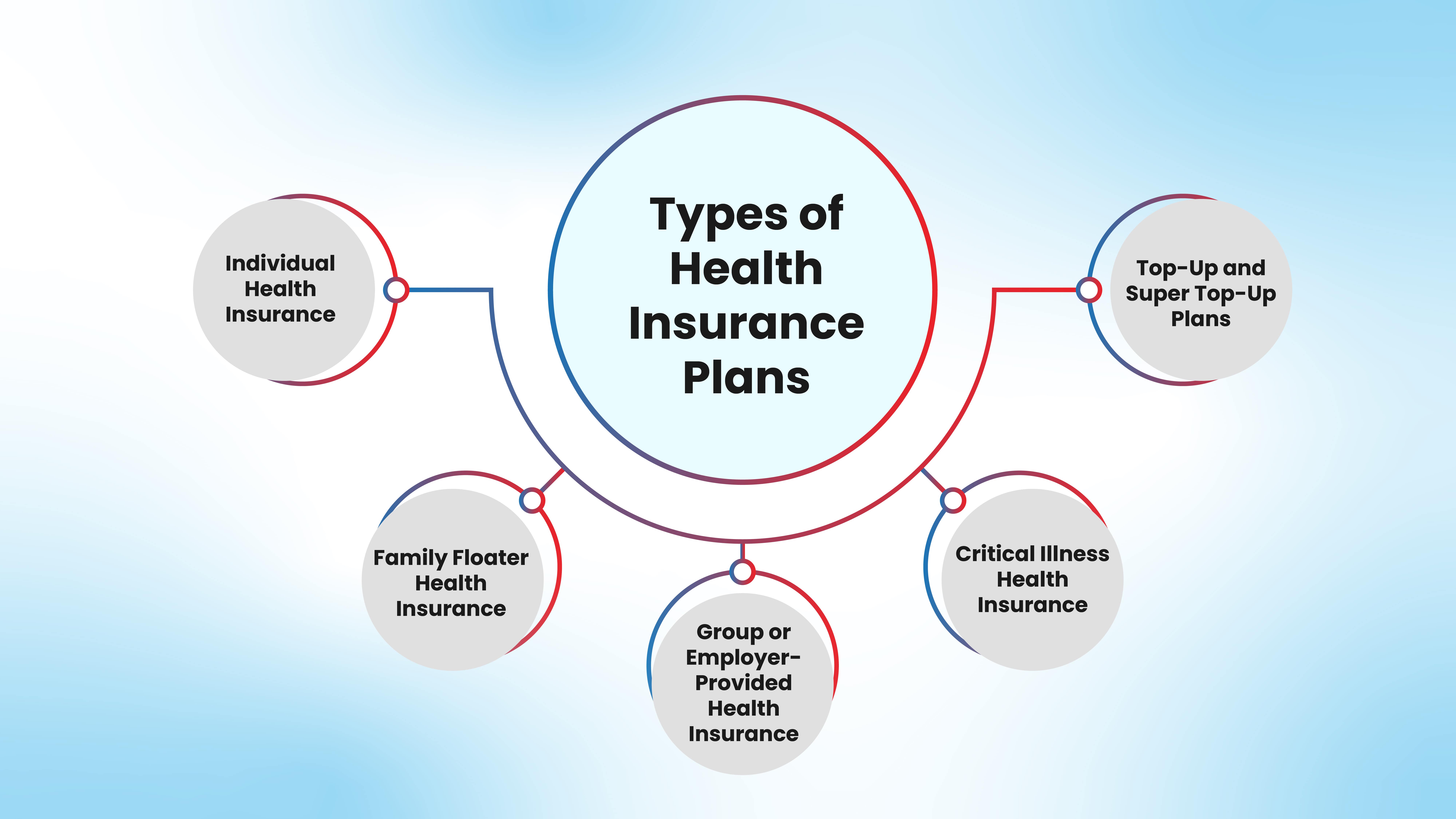

Best Tax-Efficient Investment Options for NRIs

US Dollar-Denominated Investment Plans: Shielding Against Currency Fluctuations

If you invest in US dollar-denominated plans, you are protected against currency fluctuations, ensuring that your returns do not change with local currency volatility.

International Health Insurance Plans: Wealth Protection with Tax Benefits

International health insurance plans may give you both wealth protection and potential tax breaks. These can be structured to generate high returns without breaking local laws.

Retirement Funds & Pension Plans: Tax-Free Retirement Savings for NRIs

NRIs can invest in specific retirement products, such as NPS or pension funds, which may offer tax benefits depending on the jurisdiction and local regulations. However, tax treatment on contributions or withdrawals may vary based on residential status and treaty provisions.

Real Estate Investments: Tax Implications of Owning Property in GCC & India

Investing in property is still popular. Nonetheless, NRIs should be aware that rental income from Indian properties is taxable in India, and capital gains on sale are subject to tax and TDS obligations.

To build a sustainable portfolio, NRIs often look for low-tax investment strategies for NRIs in the Middle East. These include real estate, insurance-backed investments, and offshore fixed-income products that do not attract personal income tax in most GCC countries.

Mutual Funds & ETFs: Choosing Tax-Efficient Options for Long-Term Wealth Growth

If you invest in mutual funds and ETFs, you gain the benefits of diversification and potential tax benefits. Choosing tax-efficient investments for NRIs with a long-term perspective can benefit strong returns while lowering tax bills.

Fixed-Income Instruments: Tax-Free Bonds and NRI-Focused Fixed Deposits

Fixed-income instruments such as tax-free bonds and NRI-specific fixed deposits provide consistent returns without high tax liabilities and are preferable for conservative investors.

How HDFC Life International Helps NRIs with Tax-Efficient Investments

USD-Based Investment Insurance Solutions to Maximise Returns and Minimise Tax Impact

Optimising returns and minimising the tax impact via structured planning is a key reason why HDFC Life International offers tailored USD-based investment insurance solutions.

Long-Term Wealth Accumulation with International Insurance-Backed Investments

This company presents international insurance investments that create wealth over time with roll-up potential and allow for the necessary coverage in the event of unexpected incidents that lead to large financial losses.

Flexible Financial Planning Tailored to NRI Needs in the Middle East

HDFC Life International focuses on flexible financial planning tailored to each NRI's unique circumstances, combining adaptable investment strategies with life cover to ensure comprehensive financial security.

How to Get Started with HDFC Life International's Tax-Efficient Plans

NRIs keen on discovering more about HDFC Life International's products should first work with financial advisors specialising in NRI investments to explore the right plans based on personal needs.

Factors to Consider Before Investing

Understanding Tax Treaties Between India and GCC Nations

Tax treaties determine how income is taxed across borders. Knowing this helps to avoid double taxation and adhere to Indian and local rules and regulations.

Compliance with FEMA & RBI Regulations for NRI Investments

NRIs must comply with FEMA (Foreign Exchange Management Act) and RBI (Reserve Bank of India) regulations while investing in India to keep the investment legal and avoid penalties.

Choosing Investments Based on Liquidity, Risk Appetite, and Financial Goals

Investments should be based on an individual's liquidity needs, risk tolerance, and overall financial goals. A well-balanced portfolio takes these aspects into account.

The Way Ahead for NRIs

NRIs face myriad investment options, and it's vital to understand the tax implications of these decisions. The right actions and options can make a big difference in the returns NRIs receive.

FAQs

What Are the Best Tax-Free Investment Options for NRIs in the Middle East?

The best tax efficient investment options for NRIs are real estate, USD-based investment plans, international insurance policies, and tax-free bonds for higher returns.

Are NRIs in GCC Countries Liable to Pay Taxes on Their Global Income?

Most GCC countries are not presently taxing personal income. However, Indian tax laws can apply to global earnings based on residential status.

Can NRIs Invest in Indian Tax-Saving Instruments While Residing in the Middle East?

Yes, NRIs can invest in PPF, NPS, and tax-saving fixed deposits, but it will depend on Indian tax laws whether you are eligible.

How Do Tax Treaties Between India and GCC Nations Impact NRI Investments?

Tax treaties between India and the countries where NRIs reside help avoid double taxation, which is beneficial for tax efficiency while investing in India.

What Are the Benefits of US Dollar-Denominated Investment Plans for NRIs?

A USD investment also protects you from currency risks and is globally tax efficient, making it the best choice for an expatriate.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

23 Aug 2025|6 min read

16 Jul 2025|7 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.