Insurance for HNI Wealth Protection: Secure Your Legacy

A Guide to HNI Insurance Planning to Reduce Wealth Erosion

Wealth takes years to build, but just one unexpected event to weaken. For high-net-worth individuals (HNIs), preserving that wealth is just as important as growing it. Financial goals often include legacy building, global investments and asset protection. But all of this can fall apart without a plan to manage risks. Wealth erosion does not always happen through poor choices. It often comes from ignoring what could go wrong. That is where insurance steps in. It allows HNIs to protect what they have worked hard to create while helping to manage taxes. Thus, allowing them to pass on wealth and reduce financial stress during uncertainty.

Importance of Wealth Preservation for HNIs

HNIs deal with complex portfolios, multi-market exposure and legacy responsibilities. And small setbacks could sometimes lead to large losses. In order to preserve wealth, it becomes essential to have safeguards in place that limit financial damage. Insurance serves that purpose, quietly but effectively.

Understanding Financial Risks That Lead to Wealth Erosion

Without the right protection tools, wealth can shrink faster than expected. Market swings, global crises, illness or sudden liabilities can undo years of financial planning. Insurance helps to reduce the impact of such events and to keep wealth intact.

Insurance as a Wealth Protection Tool

Insurance is a smart financial tool that supports tax efficiency. It ensures smooth inheritance and provides liquidity when needed. For HNIs, it also serves as a structured vehicle for global wealth management and succession planning.

Why HNIs Face Wealth Erosion Risks?

Market Volatility and Economic Downturns

HNIs often invest across asset classes. While this opens growth opportunities, it also increases exposure to market crashes and economic shifts. Without a capital protection plan, even a temporary dip can lead to permanent loss.

High Taxation on Investments and Assets

Taxation on capital gains, property, dividends and inheritance can reduce net returns significantly. Many HNIs overlook how much wealth they may lose to taxation over time unless they put in place strategies to reduce these outflows.

Estate Planning Challenges and Inheritance Taxes

Passing on wealth is not always smooth. Delays in paperwork, disputes among heirs or high estate duties can reduce the total value transferred. A lack of structured planning creates confusion or losses that impact future generations.

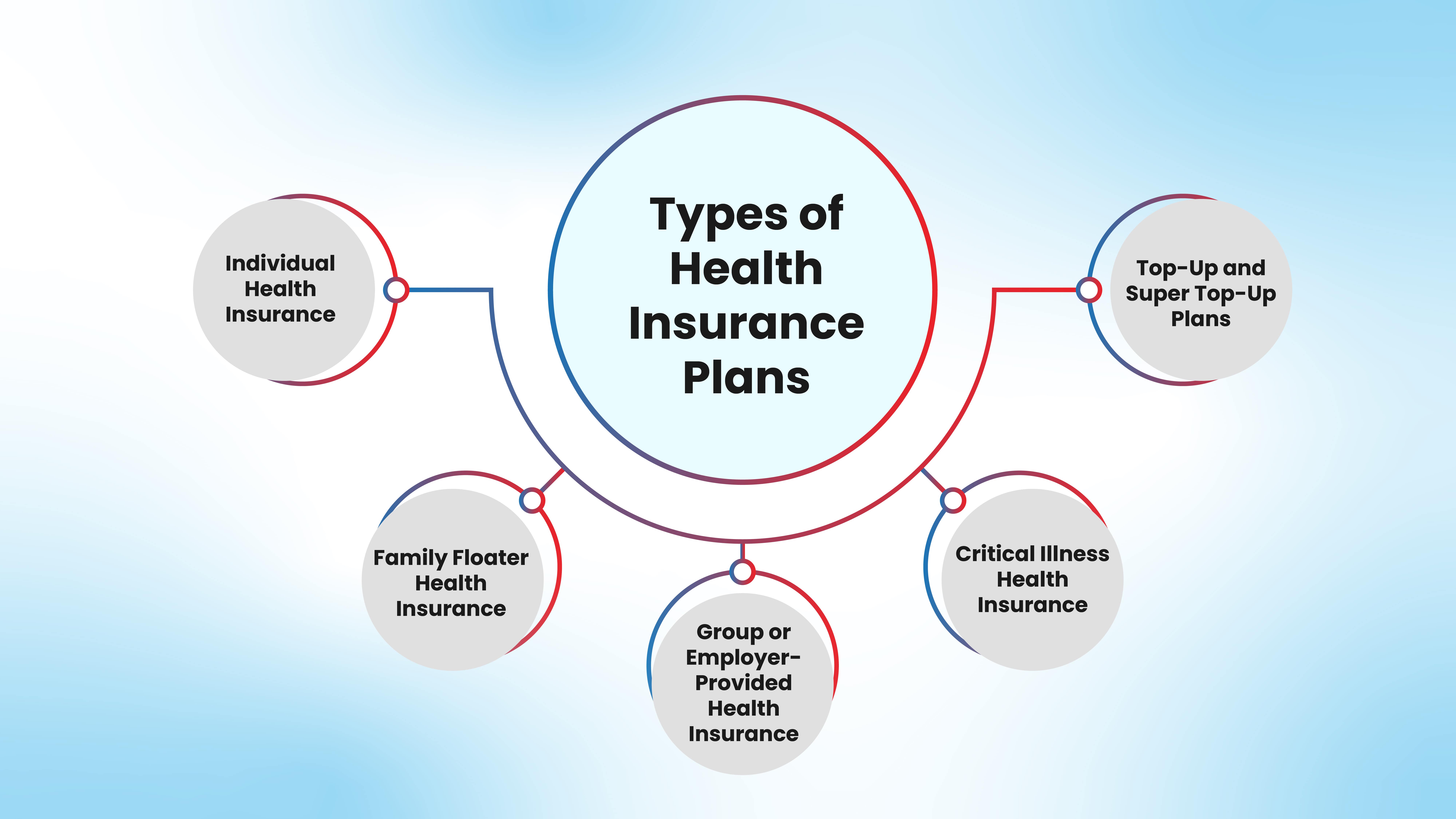

Unexpected Medical and Liability Expenses

Critical illness, medical emergencies or legal liabilities can drain resources quickly. For HNIs who lead complex professional lives or manage large estates, even a single unexpected event can bring financial strain.

How Insurance Helps Protect The Wealth of HNIs

Wealth Transfer and Succession Planning Tool

Life insurance allows HNIs to transfer wealth to the next generation without delay, tax issues or legal hurdles. It ensures that beneficiaries receive funds directly, without forcing asset sales or disputes. This provides clarity and control over legacy goals.

Tax-Efficient Estate Planning

Certain insurance policies offer tax benefits on premiums, payouts and investment returns. These reduce the estate's taxable value, preserve more wealth and simplify transfer procedures. It also helps to reduce estate duties in some jurisdictions.

Financial Risk Mitigation

Medical and critical illness insurance allows HNIs to manage large healthcare costs without dipping into investment capital. This protects long-term plans and avoids emergency asset liquidation during personal or family crises.

Long-Term Wealth Growth

Some insurance plans offer market-linked returns along with life cover. These allow HNIs to grow capital while also protecting their families and businesses. They serve dual goals—wealth creation and risk management.

Why Choose USD-Denominated Insurance

Protection Against Currency Fluctuations

HNIs with global income or investments face currency risks. A weakening domestic currency can reduce global purchasing power. USD-denominated insurance provides a buffer by keeping part of the portfolio in a resilient currency.

Global Liquidity and Financial Stability Benefits

USD-based insurance products offer access to international markets and well-established economies. This improves portfolio strength and ensures that liquidity remains available when needed, regardless of domestic financial conditions.

Access to Premium Investment-Linked Insurance Solutions

USD-denominated investment linked insurance plans often include exclusive investment options and global funds not available in domestic markets. These US Dollar plans also include higher coverage limits, flexible withdrawals and advanced customisation.

HDFC Life International's Offerings for HNIs

HDFC Life International offers USD-denominated insurance solutions designed for global Indians and international HNIs. These plans combine wealth protection along with life cover, legacy planning and international exposure. They are ideal for those who wish to grow and preserve wealth across borders.

Leveraging Insurance for Wealth Management

Asset Diversification Through Insurance-Linked Financial Instruments

Insurance helps to diversify holdings by adding low-risk, tax-efficient instruments to the portfolio. This improves resilience and reduces overall volatility.

Ensuring Wealth Protection Across Multiple Jurisdictions

International insurance products allow HNIs to protect assets in multiple countries. This is useful for those with cross-border interests, residency in multiple locations or global family structures.

Estate Planning with Life Insurance for HNIs

When used with trusts or wills, life insurance can simplify inheritance. It reduces taxes and ensures that wealth is passed on exactly as intended.

Tax-Efficient Withdrawals and Policy Loans for Liquidity Needs

Many policies offer flexible withdrawals or policy loans that provide liquidity without disturbing core investments. This can be useful during financial crunches or to meet personal obligations without triggering taxes.

The Essential Role of Insurance for HNI Wealth Protection

HNIs must do more than grow their money. They must keep it safe. Insurance is a trusted way to cut down risks, save on taxes and plan ahead. Whether someone wants to help their family, look after assets in different countries or stay ready for tough times, insurance helps to keep wealth protected and easy to access. For those who want their wealth to last for future generations, insurance is not something extra. It is an important part of any long-term money plan.

FAQs

How does life insurance help in estate planning for HNIs?

Life insurance allows smooth wealth transfer. It provides direct payouts, reduces estate duties and simplifies legal processes.

Can insurance provide liquidity for HNIs in times of financial uncertainty?

Yes. Some policies offer partial withdrawals or policy loans that give access to funds without selling other assets.

What are the advantages of USD-denominated insurance for HNIs?

It protects against currency risk, provides global access, and offers premium investment options that are not always available in domestic market.

How can HNIs use investment-linked insurance for wealth growth?

These plans provide market exposure along with life cover, allowing HNIs to grow wealth while staying protected.

What tax benefits do HNIs get from life and health insurance?

Depending on the product and jurisdiction, HNIs may receive tax exemptions on premiums, payouts and investment returns.

Author

Editorial Team of HDFC Life International

Disclaimer:

The information provided in this blog is intended for general informational purposes only. HDFC International Life and Re Company Limited, is committed to delivering accurate and up-to-date content, but we do not guarantee the completeness or accuracy of the information. The content on this blog is not meant as professional advice and should not be considered a substitute for consulting with a qualified expert in the field of insurance or financial planning and advisory matters. Decisions based on the information in this article are solely at the reader's discretion.

We may occasionally include external links to third-party websites for additional information. HDFC International Life and Re Company Limited does not endorse or have any control over the content of these external websites and is not responsible for their accuracy, reliability, or compliance with legal regulations. While we strive to offer valuable insights and guidance, the information in this blog is subject to change without notice, and we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability of the information provided.

By using this blog, you agree that HDFC International Life and Re Company Limited and its authors will not be held liable for any direct, indirect, or consequential damages arising from the use of the information contained here. We recommend consulting with a qualified professional for specific advice related to your unique situation.

Recommended blogs

Stay in touch

Subscribe to our newsletter and stay updated.

Related posts

02 Sep 2025|6 min read

23 Aug 2025|6 min read

16 Jul 2025|7 min read

HDFC International Life and Re Company Limited, IFSC Branch

FCRN: F06803 & IFSCA Registration No.: IFSCA/IIO/006/2022-23(Regulated by the IFSCA)

Registered Branch Office and Address for Correspondence: Office No. 213, Hiranandani Signature, Second Floor, Block 13B, Zone - 1, GIFT SEZ, Gift City, IFSC, Gandhinagar, Gujarat, India - 382050.

The registered marks including the name/letters "HDFC" in the name/logo of the Company/branch belongs to HDFC Bank Limited ("HDFC Bank") and the name/letters "HDFC Life" is used by HDFC Life Insurance Company Limited ("HDFC Life") and its subsidiary, HDFC International Life and Re Company Limited under a licence/agreement between HDFC Bank and HDFC Life.

For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

PLEASE EXERCISE CAUTION REGARDING DECEPTIVE PHONE CALLS AND FRAUDULENT OFFERS.